Export to Bloomberg Income Tax Planner Bot

This integration is still in development and will be added as soon as possible. Contact us for more status updates.

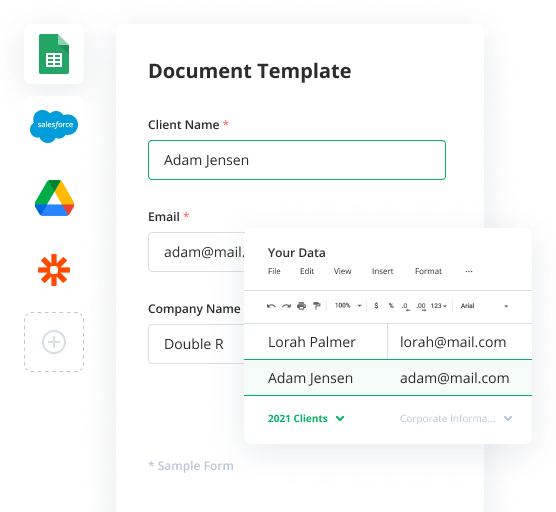

Meanwhile, you can automate your workflows using 100+ no-code bots currently available in airSlate.AirSlate encourages customers to operate faster and more efficiently with a Workspace designed for powerful, digital collaboration

Get your automated workflows up and running in minutes with the Export to Bloomberg Income Tax Planner Bot. No coding required.

Install Export to Bloomberg Income Tax Planner Bot to automate your workflow

How to use the Export to Bloomberg Income Tax Planner Bot

AirSlate is the actual only alternative no-code, multi-cloud, built-in and configurable workflow solution for encouraging you overcome your business with smart automation Bots. Use the Export to Bloomberg Income Tax Planner Bot to boost, regulate and track your necessary operations in a single secured Workspace.E tax planner.

Operate the recommendations below to set up the Bot with no problem:

- 1. If you don’t have an airSlate profile, sign-up and log in.

- 2. Complete a Flow and get a new document. E tax planner.

- 3. Select Bots and choose the Export to Bloomberg Income Tax Planner Bot from the selection. Income tax planner.

- 4. Click Add Bot, сhouse it from the collection, and edit adjustments.

- 5. Set and choose issues that’ll result in the Bot (Recipient/Date/Flow). Income tax planner.

- 6. Press Apply setup to complete the configuration.

Configure the Export to Bloomberg Income Tax Planner Bot and take advantage of an improved document Flow with fewer errors, more rapid business processes, improved compliance, longer and an overall better consumer and employee experience .E tax planner.

Other Bots often used with the Export to Bloomberg Income Tax Planner Bot

How to set up and put into action Export to Bloomberg Income Tax Planner Bot into the work-flow

- Log on in your accounts. When you don't have 1 nevertheless, sign up 1.

- Start off configuring your Flow or produce a new one.

- Check out the Crawlers segment and choose the Export to Bloomberg Income Tax Planner Bot from your dropdown collection.

- Chart out career fields and tailor the options in your desired goals.

- Determine performance problems to stipulate when you really need the Bot to do something.

- Take advantage of Innovative options to pay particular specifications without the need of using more instruments and solutions.

- Click on Implement installation and begin the test run.

- Develop a Flow and disperse your Flow.