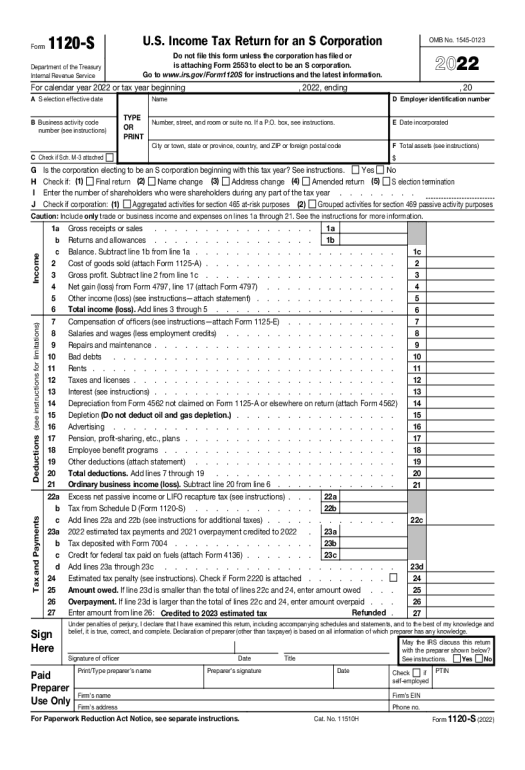

Pre-fill 1120s form fields from a CRM, Spreadsheet or database records

-

Pre-fill from Airtable Bot Pre-fill documents with data from Airtable

-

Pre-fill dropdown from Airtable Bot Pre-fill dropdown fields with data from Airtable

-

Pre-fill with Custom Data Bot Pre-fill documents with custom values

-

Pre-fill from Doc to Doc Bot Pre-fill a document with data from another document or within the same document

Extract data from 1120s form to a CRM, Spreadsheet or database

Archive 1120s form to Google Drive, Dropbox, OneDrive and other cloud storage services

Assign recipients to fields and route the document automatically

Automate repetitive tasks in CRMs, G Suite, and other systems of record

-

Pre-fill from CSV file Bot Pre-fill documents with data from a CSV file

-

Pre-fill from CSV File dropdown options Bot Pre-fill dropdown fields with data from a CSV file

-

Pre-fill from Excel Spreadsheet Bot Pre-fill documents with data from a XLS/XLSX file

-

Pre-fill Dropdowns from Excel Spreadsheet Bot Pre-fill dropdown fields with data from a XLS/XLSX file

Save an average of 8 hours per week with an automated 1120s form workflow

Spend an average of 10 minutes to complete a 1120s form document