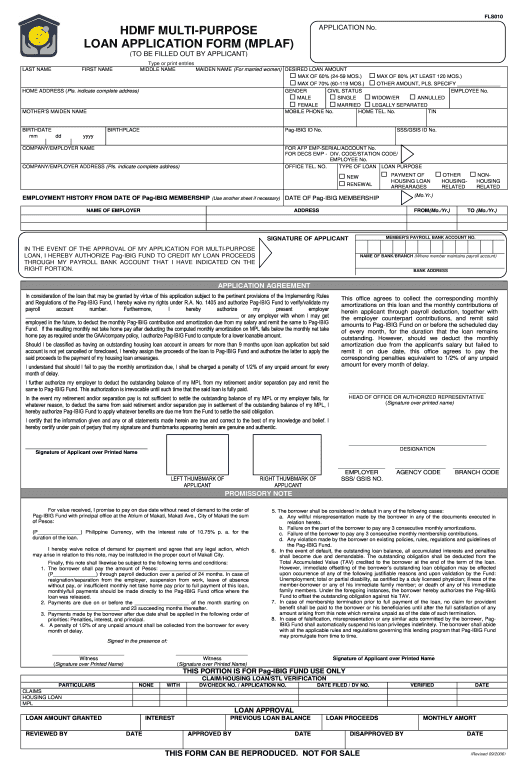

Pre-fill pag ibig loan form 2020 fields from a CRM, Spreadsheet or database records

-

Pre-fill from Airtable Bot Pre-fill documents with data from Airtable

-

Pre-fill dropdown from Airtable Bot Pre-fill dropdown fields with data from Airtable

-

Pre-fill with Custom Data Bot Pre-fill documents with custom values

-

Pre-fill from Doc to Doc Bot Pre-fill a document with data from another document or within the same document

Extract data from pag ibig loan form 2020 to a CRM, Spreadsheet or database

Archive pag ibig loan form 2020 to Google Drive, Dropbox, OneDrive and other cloud storage services

Assign recipients to fields and route the document automatically

Automate repetitive tasks in CRMs, G Suite, and other systems of record

-

Pre-fill from CSV file Bot Pre-fill documents with data from a CSV file

-

Pre-fill from CSV File dropdown options Bot Pre-fill dropdown fields with data from a CSV file

-

Pre-fill from Excel Spreadsheet Bot Pre-fill documents with data from a XLS/XLSX file

-

Pre-fill Dropdowns from Excel Spreadsheet Bot Pre-fill dropdown fields with data from a XLS/XLSX file

Save an average of 8 hours per week with an automated pag ibig loan form 2020 workflow

Spend an average of 10 minutes to complete a pag ibig loan form 2020 document