By clicking "Use Template", you agree to the Terms of Service and Privacy Policy

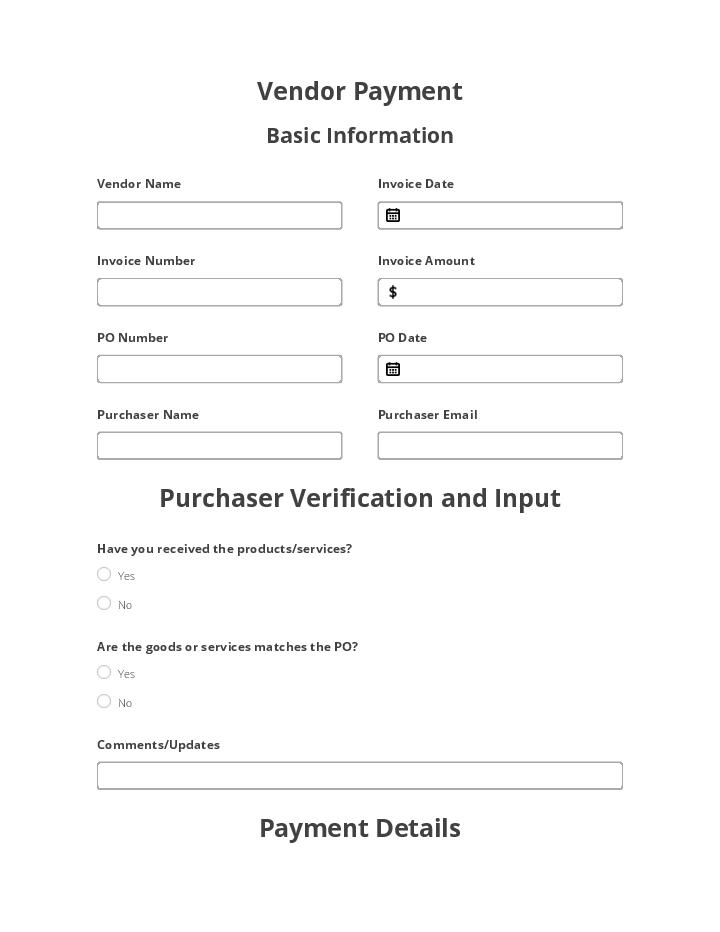

Improve Vendor Payment accuracy with Flow template

By clicking "Use Template", you agree to the Terms of Service and Privacy Policy

No-code Automation and Integration Bots

Pre-fill Vendor Payment fields from a CRM, Spreadsheet or database records

Extract data from Vendor Payment to a CRM, Spreadsheet or database

Archive Vendor Payment to Google Drive, Dropbox, OneDrive and other cloud storage services

Assign recipients to fields and route the document automatically

Automate repetitive tasks in CRMs, G Suite, and other systems of record

How it works

Enterprise‑grade security and compliance

Check out the airSlate Academy

Learn all automation How-to’s for FREE in less than 5 hours!

Automate document workflows with airSlate products

Questions & answers

Yes, sure. And airSlate offers myriad options to do so. Apart from robust automation capabilities that let you Vendor Payment with minimal efforts, it includes a feature-rich document editor where you can professionally edit existing documents or create one from scratch. Our solution also provides you with ready-to-use templates if you’re not sure where to start.

airSlate is a highly intuitive and easy-to-use platform that doesn’t require from you any prior tech knowledge or experience using programming languages or frameworks. If you need any assistance editing your very first document, our dedicated support team is always here to give you a helping hand. Also, before you proceed to Vendor Payment , you can take advantage of our numerous learning possibilities.

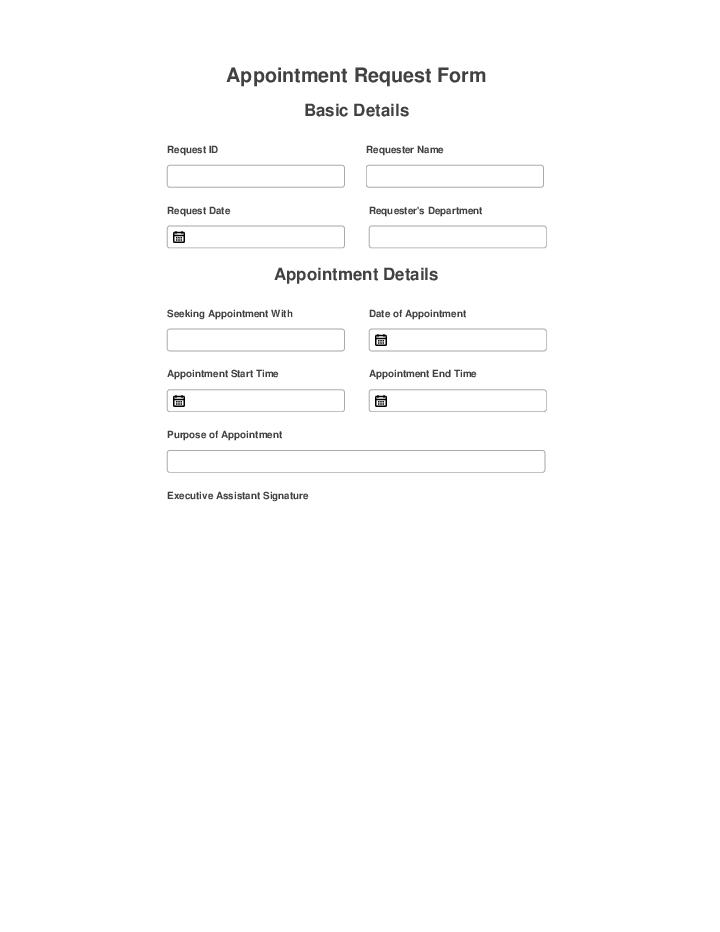

Select a new Template or open an existing one in the All Templates tab on the left of your Dashboard. Upload a document or create one from scratch. Edit your document, predefine conditions for the document fields, assign roles, and add Bots to Vendor Payment .

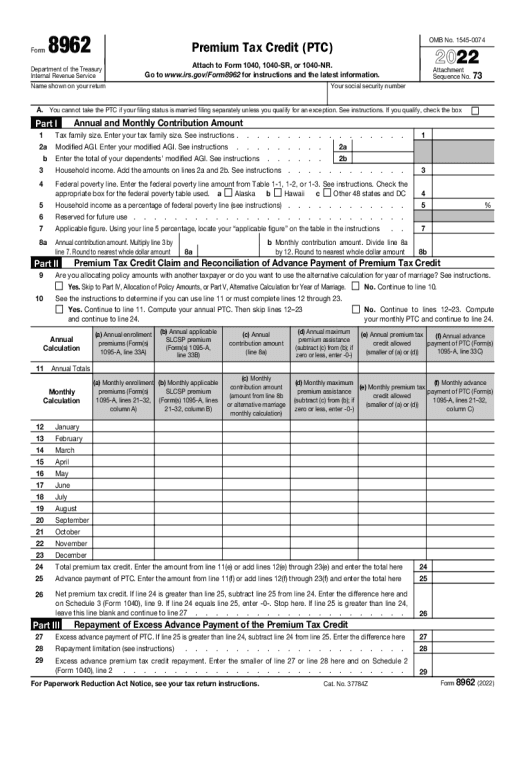

On the left-hand side of the Dashboard, select your Template. Click on the Template options in the top right corner and choose Export fields data. Pick the document within your Template, indicate the necessary details, and select the fields from which you would like to export data. Go to your email inbox and download the report in CSV format.

airSlate is an affordable no-code cloud-based solution with a holistic approach to workflow automation. The wide array of the airSlate features includes industry-compliant esignature solution, RPA, contract negotiation, and document generation solutions. With airSlate, you can fine-tune and automate virtually any business process saturated by routine and mundane tasks.

Whenever there’s a need to Vendor Payment , there’s a high chance you’ll be challenged with repetitive tasks, like sending reminders, exporting and importing data from completed web forms, and creating records in CRMs. At airSlate, all these tasks can be performed by Bots.

No. You can take advantage of every integration or automation Bot to Vendor Payment that airSlate offers without paying any extra fee. On top of that, you can use them as many times and for as many documents as you need.

At airSlate, we provide an extensive range of free courses (by airSlate Academy) and educational materials to make your very first experience with our platform smooth and seamless. You can enroll in the course at any time and take it on your own terms.

Security and compliance are always among our top priorities. We adhere to regulations and statutes concerning eSignature (UETA, eIDAS, eSIGN Act), (SOC 2 Type II, PCI DSS certification FERPA, CCPA, HIPAA, and GDPR). When you Vendor Payment , you can be assured that your documents will be compliant and your sensitive information is kept away from the prying eyes.

Sure. You can Vendor Payment and collaborate on it with your colleagues. With airSlate, you can add as many teammates as you need, manage their access level, and work better as a team on document-based workflows from one secure place.

Vendor Payment by State

- Illinois

- Texas

- Arizona

- California

- Florida

- Indiana

- Ohio

- North Carolina

- Michigan

- Massachusetts

- Tennessee

- Washington

- Kentucky

- Oregon

- Nevada

- Oklahoma

- New Mexico

- Missouri

- Minnesota

- Georgia

- Colorado

- Nebraska

- Kansas

- Louisiana

- Pennsylvania

- Alaska

- New Jersey

- Alabama

- New York

- Arkansas

- Utah

- South Dakota

- Connecticut

- Iowa

- Idaho

- North Dakota

- New Hampshire

- South Carolina

- Wisconsin

Take Advantage of a Pre-Built Vendor Payment Automation in Accounting & Finance. Payment workflow platform

Bring in our Vendor payment vendor process workflow platform Payment vendor process automation to your Accounting & Finance workflow to minimize your routine operations times while accomplishing duties more accurately. Accounting specialists on your team won’t waste any more of their time on repetitive payment workflow platform manual routines. Instead, you can lift them off their shoulders with easily configurable Bots that do all the tedious jobs vendor template for your team. Check out the benefits that come with Vendor Payment automation by airSlate:

- Accumulate vast amounts of accurate data.

- Manage access to restricted or sensitive documents and track all changes made to them.

- Optimize staff working hours with our logic-driven automated document routing workflows.

- Transfer your collected data to your CRM without errors or data loss.

- Easily collaborate with your team and edit documents within a single online workspace.

Achieve more strategic goals with your accounting team by having your mechanical workload reduced with Vendor Payment automation. With airSlate, your end-to-end workflow will be at your fingertips, and it doesn’t require any special skills to get started.